A Post-Council Analysis: Selling City Parcels to Jacobs Entertainment

Last-minute changes, altered terms, ditched staff presentations & more

I hope this finds all of you safe and well. I’ll be closing this post with a quick preview of the development-related projects on tap for discussion by City Council on August 11. But before that I have to take a step back and discuss the terms of sale for those two downtown City parcels to Jacobs Entertainment, one of the July 28 City Council items I previewed in my last Brief.

As a gaming industry site reported, Jacobs had “sweetened the deal,” offering to pay the City a total of more than $3 million for the parcels at 290 Keystone and 0 West Second Street and providing an additional kicker—25% of the net proceeds should Jacobs sell the parcels they’ve assembled to a third party, as they’re almost sure to do. You can read the Reno Gazette-Journal’s more nuanced coverage here.

But when it comes to the sale of City property, there’s more to a deal than the financials alone, and various anomalies of this one—from the introduction of a completely new offer by Jacobs the morning of the meeting to a slew of unacknowledged revisions to the option agreements—appear to run counter to the City’s stated commitment to the principles of transparency, accountability, and responsible redevelopment planning.

A short stroll down memory lane

Those who read my previous piece may recall my concern about the vagueness of the proposed deal, as presented in the meeting materials made available in advance. Recall that the Jacobs’ two-year options to purchase these two City parcels were about to expire (one may already have), prompting the effort to extend, restate and amend them.

My concerns stemmed from a convergence of several factors:

The Resolution to amend the 2019 option agreements curiously left the purchase prices for the parcels blank, rather than indicating that each would be sold at “the appraised value of the property,” as the original 2019 agreements had stated.

This past April, Jacobs stated their desire to purchase both at an absurd discount.

The new staff report stated that “The proposed revisions would discount the previously agreed upon purchase price” without revealing any exact numbers.

Put all these together and it was pretty obvious that Jacobs would be coming to the table on July 28 with offers below the appraised value of the parcels, and that the Resolutions as drafted by City staff would give City Council the freedom to fill in the purchase prices with whatever numbers they agreed upon in the July 28 meeting.

Recall too that I also expressed concern that Jacobs might come in with something at the very last minute that would attempt to influence the Council to give them what they wanted (I thought it might be fancy architectural renderings of their proposed project). And I ultimately didn’t support approving any revised option agreements at this meeting, because of the absence of a suggested purchase price or any indication of possible conditions of sale. That left the public (and Council) with very little to review.

I sent an email with a link to my post to the Mayor and City Councilmembers on the morning of Tuesday, July 27, hoping that my analysis of the vague Resolutions might help them, too, and immediately received a gracious reply from Councilmember Devon Reese, who thanked me, said that he had read it, that we would have to “agree to disagree” on some things (although he didn’t specify what), and that I should consider running for elected office in the future (a little off-topic, but nice, right?).

Which brings us to the morning of the meeting, Wednesday, July 28.

Now, anyone with an Internet connection can watch these meetings live or after the fact, and I hope many more will consider doing so, because it’s important and illuminating to see your City government in action. To help everyone understand what happened at this one, I’m going to include some links that will take you to the specific point in the meeting that I’m discussing, so feel free to click along as we go.

Strange Beginnings

Immediately after public comment—which, strangely, took place before any staff presentations or discussion (that’s not standard for our local public bodies, and doesn’t allow the public in attendance to respond to any new information that might be presented)—the City’s Community Development Director, Arlo Stockham, stepped to the podium. This was the moment when City staff would typically introduce the item, give a short presentation, and briefly summarize the staff report and recommendations (if any), in order to prepare Council for questions and discussion.

Instead, Mr. Stockham said this (watch).

“Some new ‘concessions,’ I would say, have been offered by the applicant this morning which renders this slideshow largely obsolete. So it’s a little bit unusual but I think in this case it would be best to have the applicant present those changes here first. We have reviewed them—Jeff Limpert and Jasmine Mehta [City Management Analyst and Deputy City Attorney, respectively] have been working very hard on these agreements and related matters, so maybe we can have Mr. Gordon [the representative for Jacobs Entertainment] present the changes and follow up with any questions for staff that you may have.”

So the presentation that City staff had prepared to show City Council to introduce the terms of these options was no longer pertinent due to something Jacobs had brought to the table that very morning? A little bit unusual? That’s putting it mildly.

Councilmember Jenny Brekhus (watch) asked Mr. Stockham if, before handing the dais over to Mr. Gordon, he could clarify what they were actually to be reviewing for possible approval. And he said that Council was voting on Resolutions that would refer to the option agreements, but that the complete agreements themselves were only distributed by memorandum to Council “yesterday,” meaning Tuesday, July 27, less than 24 hours before the meeting (and the day after I published my Brief).

File that away for a moment, because those amended option agreements—which Council would be “resolving” to allow City Manager Doug Thornley and Mayor Schieve to finalize and execute, closing the sales—were documents the public never got to see, and whoever negotiated them with Jacobs made a lot of decisions they never even discussed with Council—not in public, anyway.

The Offer from Jacobs

Then the Jacobs representative, land use attorney Garrett Gordon, stepped up with his presentation, revealing Jacobs’ offer and proposed terms for sale of the two parcels. His presentation was sprinkled with references to the “Neon Line District” (more on that later) and finally, the proposed purchase prices were revealed. (watch)

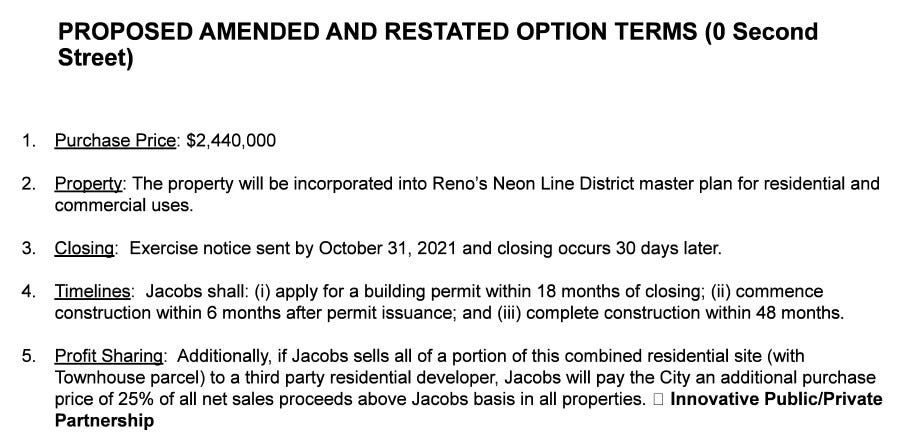

Here’s Mr. Gordon’s slide about the parcel on West Second Street, adjacent to the former site of the Town House Motor Lodge (view his entire powerpoint here).

As you can see here, Jacobs was offering a purchase price of $2.44 million for the Second Street parcel, approximating its 2020 appraised value. Another slide offered $631,600 for 290 Keystone, approximating a 2020 appraisal for that one. But they included two other terms that were peculiar for City parcel sales:

The indication that the parcel would be incorporated into the master plan for “Reno’s Neon Line District”—a district that does not yet (and may never) exist.

That profit-sharing arrangement for 25% of the net sales proceeds.

The “Neon Line District” is, of course, the name that Jacobs Entertainment hopes to convince the City to apply to the part of downtown bookended by its two casino properties, the Gold Dust West and The Sands. I like to refer to this whole “Neon Line” initiative as a form of “stealth branding,” where they repeat the phrase “Neon Line District” over and over again in hopes that it will enter the City lexicon, eventually making its official designation seem like just a formality. Don’t fall for it.

The attempt to codify that “district” will clearly be part of the Development Agreement (DA) that Jacobs plans to bring back to Council. And I hope that when they do, they won’t try to retroactively add up everything they’ve done on their own, from the rows of sculptures they’ve privately selected and erected on private land, to charitable donations they’ve already made, and list them in the column of “public benefits” (which should only cover what they will do from that point forward).

When Mr. Gordon stated his intent to bring that DA back to Council in August, Councilmember Naomi Duerr reminded him that Council had specified that a public workshop about that proposed agreement be held prior to any Council decisions about it. (watch) Mr. Gordon replied that it was his understanding that a workshop would only be required if they were going to be incorporating Tax Increment Financing (TIF) (as they proposed in April) and since they no longer intended to do that (which was good news) a public workshop wouldn’t be necessary.

[9-14-21 EDIT: I may have heard this wrong. It sounds like what Mr. Gordon actually said was that he didn’t believe that there would have to be a public workshop prior to the discussion of their forthcoming Development Agreement, since without the City parcel sales there “wasn’t much to it.” But he did say that his understanding was that a public workshop should precede any decision-making about creating a TIF district.]

Councilwoman Duerr replied that she believed the workshop was intended to discuss the terms of the DA regardless of the TIF and asked the City Manager to check on that (p.s. I did, and she’s right).

The last component of the surprise deal was the profit-sharing offer, which Mr. Gordon described as a “public-private partnership,” but that’s a bit of a stretch. In terms of land development, a public-private partnership (PPP) can take many forms, but this is just a financial arrangement where Jacobs is offering the City a potential cut of their own private real estate deal: the higher the sale, the larger the profits for both.

The Staff Presentation That Wasn’t

Financially speaking, Jacobs seemed to have delivered, and more, on its original agreement. But I couldn’t help wondering what had been in the presentation that Mr. Stockham had planned to show, and what last-minute “concessions” from Jacobs had made it “obsolete”? Nobody said. But after the meeting, his presentations on the two parcels were posted online and revealed a very different deal.

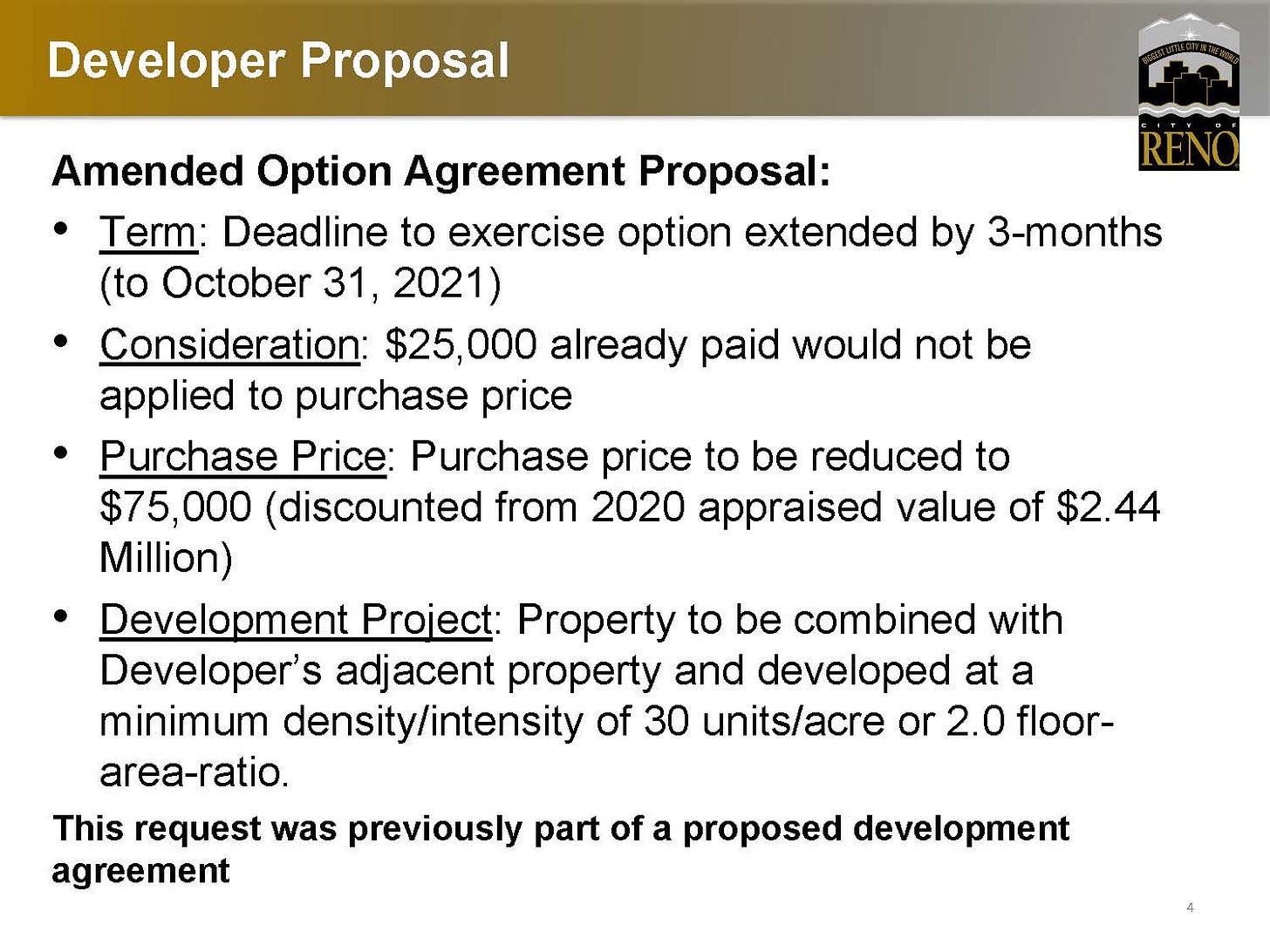

Here’s one of those slides, listing the “Developer Proposal” for the parcel on West Second Street (you can view the entire powerpoint here and the one for 290 Keystone here). In the words of the illustrious Samuel L. Jackson, hold onto your butts.

I’ll direct your attention to the third bullet point—the one that reads, “Purchase price to be reduced to $75,000 (discounted from 2020 appraised value of $2.44 million).”

That’s right, $75,000. And the other powerpoint shows the same proposed price for 290 Keystone Avenue: $75,000.

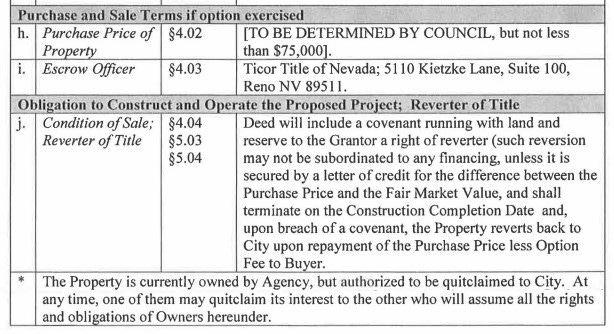

So up until the very morning of the meeting, Jacobs was planning to offer the City just $75,000 for each parcel. And confirming that amount were the terms of the new option agreements that City Manager Doug Thornley had finally distributed to Council on Tuesday (after Councilmember Brekhus had requested them, according to a memo that was also posted). They revealed that Council would have the option to set the price of each parcel at a minimum of that same number: $75,000.

Does that mean that the City Council was automatically going to vote to sell Jacobs the parcels for just $75,000 each? Of course not. But that’s the offer that the City staff was entertaining from Jacobs until Wednesday morning.

So why would Jacobs suddenly raise their offer for the two parcels from a total of $150K to more than $3 million, when they were supposedly working on this deal with City staff for weeks, even months? I don’t know. Maybe they had a last-minute change of heart. Maybe they grew concerned about the optics of lowballing the City after paying full market price (or more) to the owners of every other privately-owned parcel they’ve purchased in the neighborhood. Could be a combination of things.

But another explanation may be found in the additional terms they negotiated in the amended agreement—changes that nobody even mentioned during the Council meeting, and that I suspect most people haven’t seen. I didn’t even notice them myself until a few days ago—and I’ve been paying very close attention.

The “amended” terms that went unmentioned

When I was researching my previous post, I noted that the original option agreements had required Jacobs to return to City Council before exercising their purchase options to reveal their specific plans for the parcels.

After Mr. Gordon introduced the added “bonus” of profit-sharing, I wondered what ability, if any, the City would have to determine what Jacobs actually builds on these sites. If maximizing revenue were now a primary motivating factor, for instance, then it would seem even less likely to result in something like affordable or workforce housing. So did the amended requirement make any provision for the City to regulate, or at least to review, what might actually be developed there?

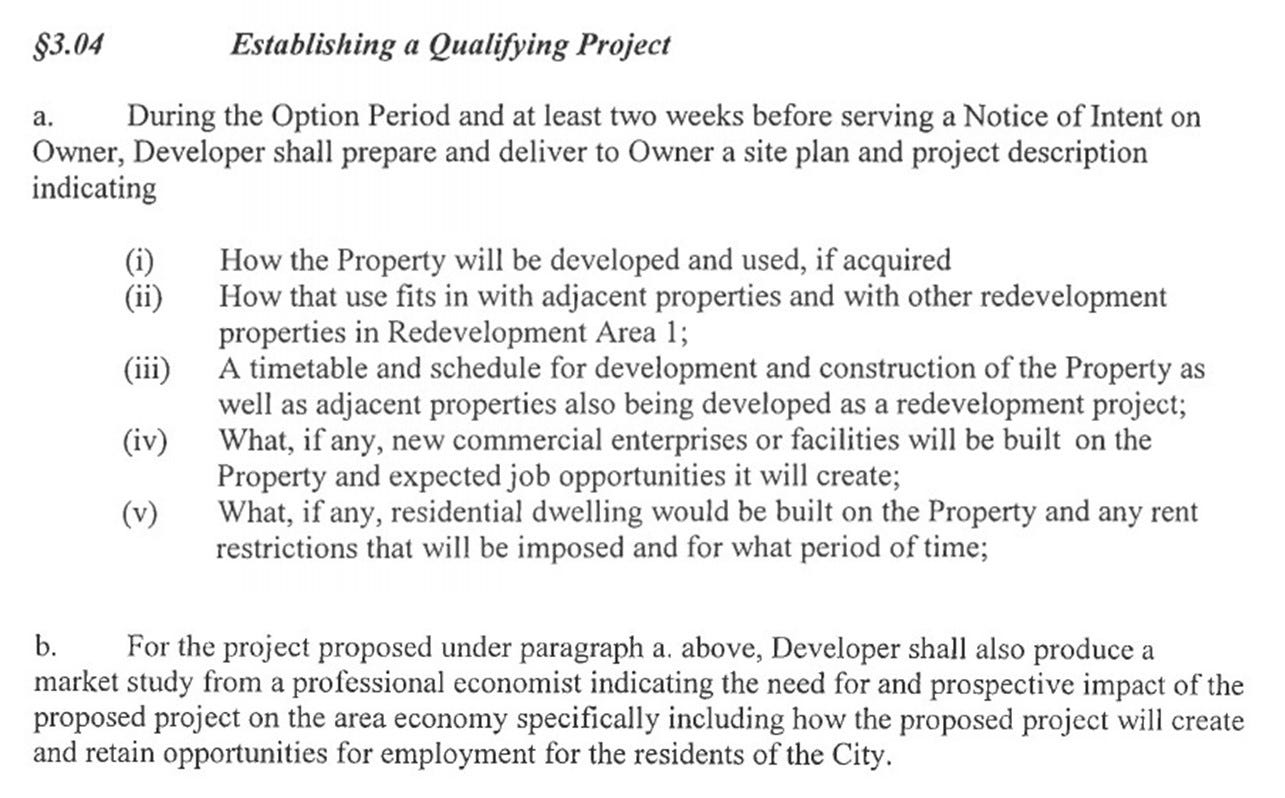

That question took me back to the full text of the amended option agreements (view here), which, as I said, were not available when I wrote my additional post. And what they revealed was stunning: a key section of the original 2019 purchase option agreement for 0 West Second Street had been completely deleted—the section that defined what “a qualifying project” had to provide in order for Jacobs to exercise its purchase option on that parcel.

That deleted section outlined some very specific requirements to be met before the sale could close, including the delivery of a site plan and project description, an explanation of how the project would fit in with the surrounding properties and broader redevelopment area, and what rent restrictions, if any, would be imposed there. It even required the company to commission “a market study from a professional economist indicating the need for and prospective impact of the proposed project on the area economy specifically including how the proposed project will create and retain opportunities for employment for the residents of the City.”

That sounds like great redevelopment practice. And yet, in the “amended” 2021 option agreement, all of that language was gone (a “market study” requirement for 290 Keystone was eliminated, too). And neither its prior existence or its deletion were mentioned to City Council, who weren’t shown a side-by-side comparison of the 2019 and 2021 agreements at all. The only requirements for a “Qualifying Project” now are that it meet the broad definition of “economic development” described in NRS 268.063, along with a minimum density of 30 units per acre for residential projects or a floor area ratio (FAR) of 2.0 for mixed use or non-residential.

So to review:

Jacobs had planned to offer the City $75K per parcel, but drastically altered their offer at the last minute, leaving City staff with an “obsolete” presentation and practically nothing to say.

The new agreements not only aligned the sales prices with “stale” (older than six months) appraisals, but included terms that the public was not allowed to review in advance, and that Council was only provided less than 24 hours earlier.

This parcel sale is linked to future negotiations presupposing the creation of a “District” that doesn’t exist.

The agreement involves the City in a profit-sharing deal with a commercial developer on future projects without specifying or even suggesting what those project would be.

The new terms removed prior requirements for Jacobs to commission market studies for both projects, and to specifically establish that its project on Second Street would benefit the local economy, provide jobs, and fit in with the neighborhood, and also to confirm any “rental restrictions” should the project be residential in nature.

Additionally, according to the new agreements, construction doesn’t have to be completed on either parcel for four years, unless extended by the City Manager (in which case it could be even longer). And the deal for some reason requires both parcels to be transferred from the Redevelopment Agency to the City of Reno before selling them to Jacobs (which was never fully explained, although some Councilmembers asked about it). The Resolutions passed 6-1 with Councilmember Brekhus opposed.

I’m not sure we should feel as great about this deal as some would like us to.

“People with their own blogs and Substacks”

Lastly, I want to address something odd that happened in the middle of this discussion. Out of nowhere, Councilmember Reese took three-and-a-half minutes of his limited allotted time to tell “the community who’s watching” what meeting agendas are for, saying that they are often just “placeholders” that serve as a springboard for Council discussions, not descriptions of what the Council will do.

He went on to warn the community about “people with their own blogs and Substacks” who “think the outcome [of Council meetings] is predetermined,” and who, he suggested, were capitalizing on preexisting concerns that the City might sell these parcels on the cheap, creating a “distraction” that he termed “dangerous.” I’m not going to paraphrase the rest, but feel free to watch it yourself here.

This speech was, frankly, a bit baffling. If Councilmember Reese was referring to my previous piece on the sale of the City parcels to Jacobs (as Our Town Reno pointed out, mine was the only “blog or Substack” to write about them), he seemed unfortunately to have missed the point. So let me be perfectly clear.

I wouldn’t be writing this newsletter if I believed the outcomes of Council discussions to be predetermined. After all, as you can imagine, it’s no small task to do what I’m doing here. I read through the materials for each Council meeting as soon as they’re posted (usually 5 days before the meeting) for anything I think needs more explanation and awareness, research the background and context, write up an explanation and analysis complete with links, photos, and videos, and publish it well in advance of the meeting, so anyone who reads it can have time to read, ponder, and provide input (if they like) to Council. Would I go to all that trouble if I thought the fix was in?

Quite the contrary. In fact, I am unrelentingly (some say naively!) optimistic that the outcomes of City Council discussions are never predetermined, that there are no “done deals” (the very phrase makes me cringe), and that our Councilmembers, as our public representatives, approach each item with open minds, willing to examine and consider all new information and perspectives before reaching a final decision.

But I do think that they (and we, the public) are often not being provided with the context and information needed to do so—about development, in particular. There are a lot of reasons for that, including (but not limited to) a massive amount of staff turnover at City Hall in recent years (resulting in a devastating loss of institutional memory); the decimation of press coverage of City affairs due to massive budget and staff cuts; the heightened activities of developers’ lobbyists and land use attorneys; and in some (fortunately rare) cases, an apparent preference by some in positions of power for unilateral decision-making over inclusive and transparent public process.

Providing some of that missing context and analysis in order to increase public engagement in City development is something that my 20 years of experience researching, writing about, and participating in the complex process of Reno’s development makes me uniquely qualified to do, and I’m happy to do it.

This parcel item alone shows what can happen when public process and transparency are not prioritized. Whatever you think of the end result, City Council voted on an offer that was presented to staff that very morning—an offer the public was unable to review in advance, and that City staff didn’t even have time to incorporate into a new presentation. City staff never led our Council through a thoughtful and thorough discussion of all the revised terms, and left completely unmentioned some of the most consequential changes to the original agreements. That’s not something that should be normalized, much less held up as a model of public policymaking at its finest.

As a professional writer, researcher, college educator, and consultant, I write on a wide array of topics in a variety of formats—books, articles, websites, government reports, radio, and more. I’ve been asked to write regular (paid) features on this subject for several local media outlets. But I’ve chosen to publish the Brief, with its very narrow focus on Reno development, on the Substack platform for some very specific reasons:

It’s published as both an e-newsletter and webpage, which helps me reach the widest possible audience.

It allows me to embed images and links to other websites, articles, and videos.

I can publish on my own schedule, which is critical since I’m self-employed with other work that pays the bills, and have to fit this in when I can.

It’s absolutely free for anyone to read and share.

I’m more convinced than ever that The Barber Brief meets a community need, and I’m committed to keep writing it. The Brief is and will always be free of charge, but if you feel inclined to help make it a little more sustainable for me to produce, I’ve opened a Venmo account at @Dr-Alicia-Barber and would be very grateful for your support.

The August 11 Reno City Council Meeting

I encourage everyone to look through the agenda and materials (here) for next week’s City Council meeting. Development-related items include Logisticenter (Items C.1 and I.1), Stonegate bonds (Item F.2), appointments to the Ward 2 (Item G.1.4) and Ward 4 (Item G.1.5) Neighborhood Advisory Boards (NABs); and the release of a restrictive covenant for Riverfront Village, LLC (Item L.4).

Almost all of the NABs are back in business, with the current exception of Ward 4. You can visit this page for info on upcoming meetings and sign up here to be emailed updates on those and other City doings.

As always, you can view my previous e-newsletters, with more context, analysis, and tips, on my Substack site. Thanks for reading and have a great week!

I am going to have to pay more attention. I am thankful for you doing what you do. Mr. Reese is, from encounters I have had with him and the way he often presents himself, full of himself and rather self serving, self serving as a council member often meaning that one serves best those who have the most money.

This is quite a wild ride. Thank you for shining a light on how these deals happen in the shadows of City Hall, and demanding more transparency and fairness around land use in your town. Fight on!